Child Tax Credit 2024 Phase Out Phase – You may be eligible for a child tax credit payment — in addition to the federal amount — if you live in one of these states. . Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. .

Child Tax Credit 2024 Phase Out Phase

Source : itep.org

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

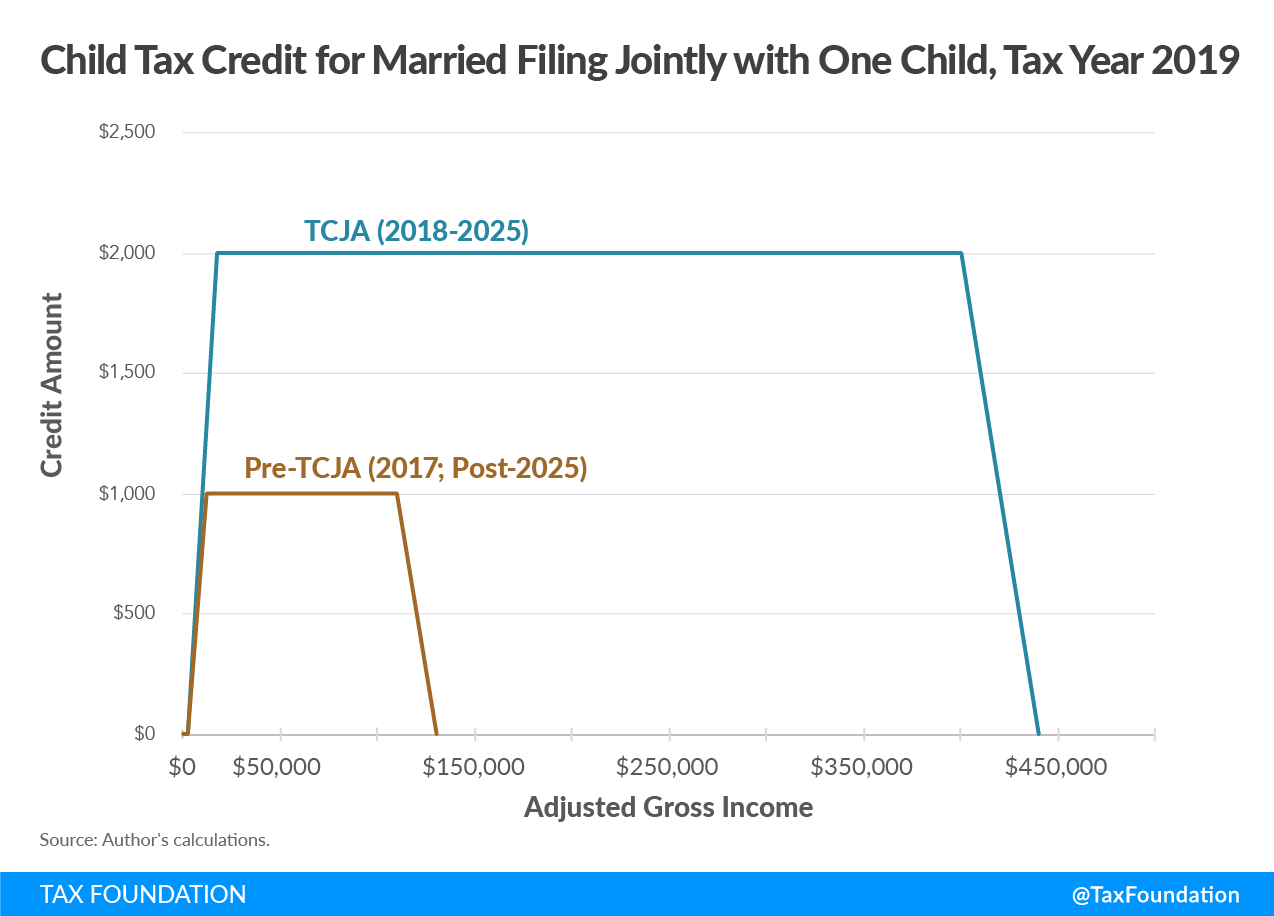

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

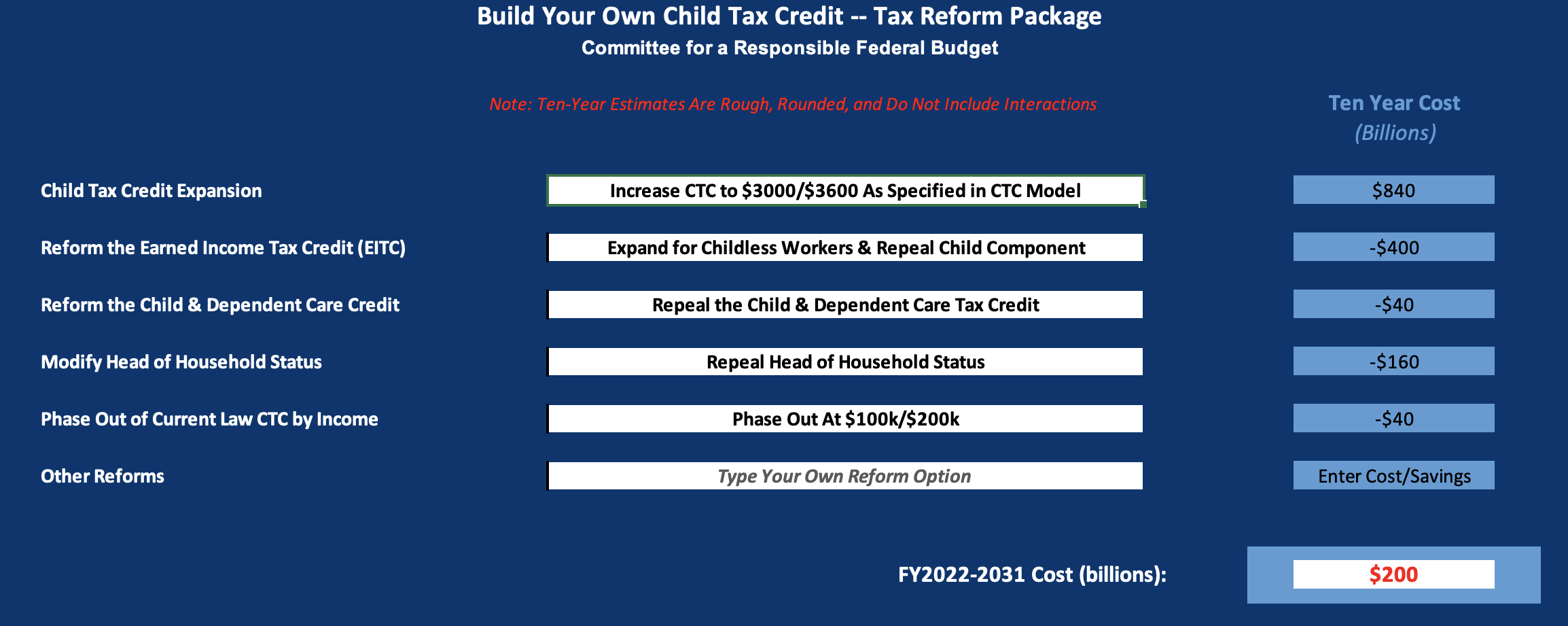

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

Government Rebates for Solar Panels | Haleakala Solar Hawaii

Source : haleakalasolar.com

Child Tax Credit 2024 Phase Out Phase States are Boosting Economic Security with Child Tax Credits in : Originally published Expanded access to the child tax credit could be on the horizon for the country’s lowest-income families through a new bipartisan deal announced Tuesday. Sen. Ron Wyden, an Oregon . will start to see the value of their credit decrease and eventually phase out. In Massachusetts, taxpayers who care for a child or elderly parent can claim a tax credit that is worth $440 for each .